Paper for the 19th International Association for Energy Economics

(IAEE) Annual International Conference, Atrium Hyatt Hotel, Budapest, Hungary

May 27-30, 1996.

PRICING OF EUROPEAN GAS

Effects of Liberalization and Petroleum Excise Taxes

In the highly concentrated structure of the European gas market, gas

is sold and resold many times on its way from the field of production to

the final user, often between monopolies/oligopolies and monopsonies/oligopsonies.

Producers (exporters) sell gas to transmission companies

(pipelines) who act both as transporters and merchants in the market.

The gas the pipelines buy at it's entry, they resell at its exit at the

city-gate to their customers; local distribution companies (LDCs),

power plants and large industrial users. The LDCs act as both transporters

and merchants, as pipelines do, and resell the gas to final consumers

(end-users) in private households and businesses. Power plants and

large industries are end-users themselves, and use gas as input factor

in production processes, such as for electricity, chemical products etc.

In general, producers and pipelines write long term contracts (up to 20

years), while pipelines write medium term contracts with its customers

(1-5 years).

| You are welcome to download,

print and use this full-text document. Proper reference to author, title

and publisher must be made when you use the material in your own writings,

in private, in your organization, in public or otherwise. However, the

document cannot, partially or fully, be used for commercial purposes, without

a written permit.

Footnotes are not shown in this version of the article. Other inaccuracies may also occur. For a complete version, please email me! |

If the market should become liberalized, gas needs not be sold and resold quite so many times as under today's system. Under a liberal market system, producers should make direct contracts with LDCs, power plants and the industry, and buy transmission services from the pipelines (as for a toll road). The fee for this transportation should cover pipelines' normal profit, but should not give any economic profit to them. Pipelines' roles as both transporters and merchants should be unbundled, and they should act only as transporters. Intermediates, such as brokers and marketers, may become new actors to clear (parts of) the market. While pipelines are often natural monopolies (or at best natural oligopolies) their behavior and pricing practices should be regulated by a public authority. Producers and customers however, are not necessarily natural monopolies. In order to create competition in these segments, sales monopolies in exporting countries should be abolished, and customers should compete for gas (as they to some extent already do in today's market). Since LDCs are natural monopolies in the areas in which they operate, it is necessary to regulate them, as well. If the market theoretically becomes completely and perfectly liberalized, each firm in the gas chain either operates as a price taker, due to perfect competition, or is efficiently regulated by a public authority. Competition should be established when possible, regulation when necessary (when competition does not work) and unbundling introduced when economies of scope are not present (or exhausted).

However, there are many reasons why the European gas market will not become completely and perfectly liberalized in the foreseeable future. Firstly, the varying degree of scale and scope economies in market segments, makes it difficult to establish an optimal portfolio of competition, regulation and unbundling throughout the gas chain. It is also difficult technically to find regulatory schedules that do not create new inefficiencies in the market. The second-best solutions liberalization often aims at, may end up as third- or fourth-best solutions in reality. Secondly, as the market develops, authorities are often slow to change regulation in an optimal manner. U.S. experiences tells us that the costs of policy making being slower than market dynamics may be significant. Thirdly, strong economic interests in firms to be regulated, lead these to lobby in order to prevent more competition and/or regulation. Fourthly, as European gas trade is international, also within a Maastricht-version of the European Union (EU), the economic reasoning behind a possible opportunistic behavior by one gas firm trading with firms in other countries may be supported by nation states which have a desire to maintain rent to the country and political influence following the firm's strong position in a market for an essential good like natural gas.

In spite of these counter arguments, it is likely that the European gas market will become more liberal than it has been. Competition between pipelines will most likely intensify, although perfect competition is not possible. Market growth indicates that competition between customers may intensify, as well. Increased demand may bring new supplying countries to the market, such as Kazakstan, Iran and others, and increase the number of oligopolists selling to the market. However, competition between firms within each exporting country seems less likely. So far, the EU has proposed 3 directives aiming at a) a more transparent market, b) allowing transit of gas between high-pressure grids and c) introducing Third Party Access (TPA) to pipeline and unbundle their role as both merchants and transporters. Among these, TPA is not introduced yet, due to heavy resistance from the industry and the European Parliament. Renewed emphasis on a politically-led liberalization of the market should not be excluded, however, in particular if liberalization is done in conjunction with a more active gas taxation policy (see discussion below).

An important difference between the European gas market and many other

markets being liberalized, is that natural gas is a non-renewable resource.

With a limited supply, and prices to a large extent fixed by prices of

alternative energies, there is an economic rent to be earned in the market,

even after it is liberalized. The total rent is determined by the difference

between market prices and the sum of cost of production, transportation,

storage, distribution, gas use et.c. (including normal profit). The existence

of, and fight over this rent among commercial and political actors, contributes

to politizising the European gas market more than most other markets. This

paper discusses price (and rent distributional) effects of gas market liberalization

and of a more active use of gas excise taxes in consuming countries.

Pricing of European gas

Contractual price formulas are mostly designed to make prices react to changes in other energy prices with a timelag, reflecting the value of gas for end-users. This value, or consumers' opportunity cost, represents a weighed average of their willingness to pay. Each end-user faces different alternative energies, either it is hydro or nuclear produced electricity, oil or coal. This principle is valid for the pricing of gas both between producers and pipelines and between pipelines and customers at the city-gate. The price of gas agreed upon in these transactions is influenced by:

1) The alternative energies contained in the formula.

2) The weight of each energy in the formula.

3) The setting of the initial relationship between the gas price and

the price of alternatives.

4) The escalation mechanism of gas prices in relation to the price

of the alternatives.

The alternative energy pricing principle has resulted in lowest prices on gas to electricity production, somewhat higher for industry, and highest for general supplies to households and businesses, due to the different alternatives faced by each consuming group. The discrimination between markets, makes the seller able to take parts of consumers' surplus without disturbing consumption patterns, compared to a situation where each consuming group are charged the same price. The Norwegian Troll contracts signed in 1986 contain renegotiation clauses of price provisions, in a way that prices continuously should reflect the competitiveness of gas in the market, even when major changes take place. Other contracts have been renegotiated on a force majeure basis.

A change in the price on the alternatives to gas leads, within a contract, rather automatically to a change in the sales price of gas to producers and to transmission networks, respectively. To a large extent, these prices are "net-backed" from the markets of alternative energies. Historically, the gross margins to LDCs and transmission companies (the difference between the prices they sell and they buy gas for) have largely been determined in a way that they do not vary with end-user prices. The margins to transmission companies are set by the negotiations with producers and customers, respectively. LDC margins are largely determined by the negotiations with transmission companies and the relationship between these prices and prices for gas in the market.

While a typical contract for exporters has a length of some 20 years, a typical contract for pipelines selling to their customers have a length of 1-5 year. In order to increase the market share for natural gas, in many contracts (such as for Troll) the initial relationship between the end-user price of gas and the price of the alternative energies is set to less than 1:1; that is, end-user prices of gas is set lower than the price of the alternatives. When pipelines write new contracts with customers, the price they agree upon is adjusted, in spite of the fact that they have signed more long-term contracts with exporters. That pipelines sell gas on more short term than they buy gas, may give them a profit or loss compared to the initial situation. However, the pipelines are bound to take-or-pay (TOP) clauses with producers, determining that pipelines must pay for (a certain share) of the gas they have contracted, even if they are not able to sell the gas. Equivalently, the LDCs may regulate their prices to end-users according to what is possible to get from the market, in spite of the fact that they (too) are bound to more long-term contracts with transmission companies than they sell on.

Thus, the (net) price to the transporters depend both on the initial relationship between the gas price and the alternatives, and how the market (for each of them) develop within the contracted period. If gas can be sold at higher prices than expected, in the contract period, transmission and/or distribution companies may benefit from that. The initial relationship between producer/pipeline and pipeline/customer prices, respectively, and the price of the alternative energies determines the base for the gross margins to pipelines and will be influenced by parties' cost of operation (fixed and variable) and negotiation strength and market power.

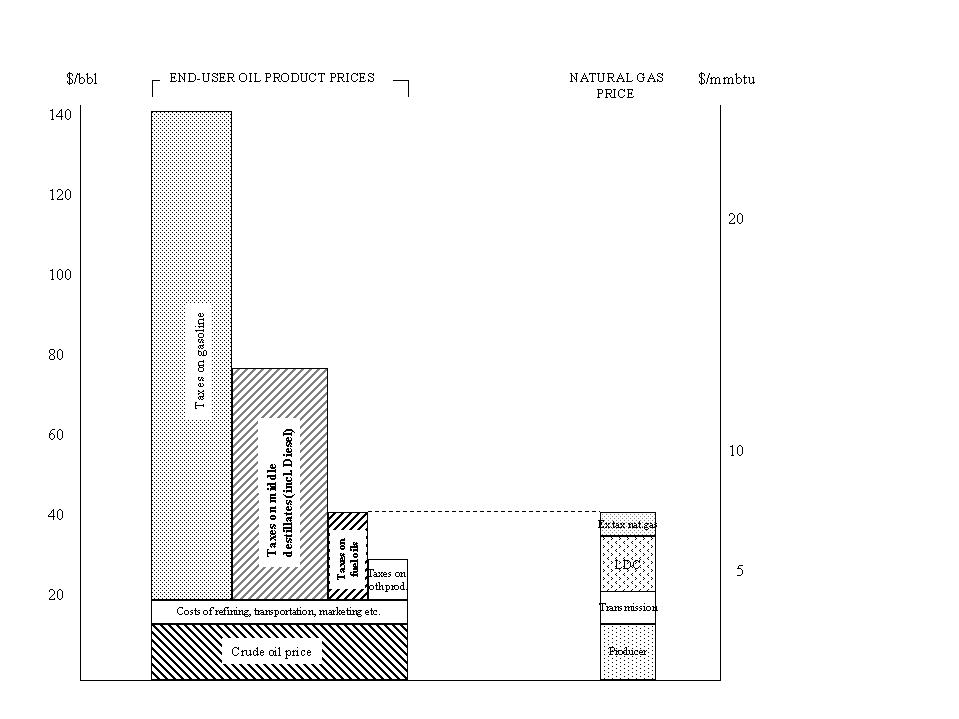

To illustrate the relationship between gas prices and the price of alternative

energies we have, in figure 1, simplified the pricing mechanism to only

reflect contracts where gas competes with fuel oils. We also disregard

the more "short term" gains and losses transmission and distribution companies

can make through changes in sales prices of gas within a contract period.

Figure 1: Gas Prices in Europe and the Relation to Oil Prices

(Simplified Illustration)

The left set of bars show end-user prices on oil products. The basis

for these prices is the price of crude oil and costs to refining, marketing,

transportation et.c. In the figure, the crude oil price and the costs are

illustrated as if they are equal across product types, even if this is

not accurate. Our point, however, is that the main difference between the

prices on different product types results from different oil product

taxation. For a representative barrel of oil, our calculations have

shown an average tax of 47 USD/bbl in OECD-Europe and an end-user price

of some 70 USD/bbl in 1994. Gasoline has the highest taxation and would

yield a per barrel price of some 140 USD in Europe, while taxes (and end-user

prices) are falling on heavier products.

Usually, prices on crude oil are set in USD/bbl (a price per volume unit of crude oil), while prices on gas usually are set in USD/mmbtu (a price per unit of energy content of the gas). The ordinates to the left and right, respectively, illustrate the relationship between the two prices. The gas price bar to the right in figure 1, shows that gas prices to end-users are determined by the price of its alternatives, here fuel oils. The price of the alternatives to gas determines the size of the "cake" to be distributed between consuming countries governments (excise taxes on natural gas), distribution and transmission networks and producers (and, thus, the frame for producing countries' treasuries take from producers). As long as the margins to LDCs and pipelines are not reacting to changes in market prices, the price of gas to the exporter can be changed in the following ways (so far keeping taxes on gas itself constant):

1) A higher crude oil price raises fuel oil prices and, thus, end-user

prices on gas.

2) Higher taxes on fuel oils also increase end-user prices on gas.

3) Higher taxes on all other oil products will, if they lower crude

oil prices, lead to lower fuel oil prices, and, thus, lower end-user prices

on gas.

4) If taxes on all oil products simultaneously are raised it is not

clear whether the taxes are under- or overcompensated of a possible lower

crude price resulting. It is the composition of oil product taxation that

determines whether or not gas prices benefit from increased taxation.

From these mechanisms, it if often said that the producer takes the

"price risk" and the pipelines takes the "volume risk" in today's market.

However, as long as price and volume are interconnected in a market, it

is the producer that over time takes most of the risk connected

with gas sales today. Nevertheless, it is thinkable that transmission companies

face so much difficulties in selling gas to their customers, that they

have to lower prices and/or volumes sold to an extent that the TOP-clauses

becomes effective. In that situation, the companies involved may face a

loss.

Table 1; OECD-Europe: Index for real gas prices;

end-user and import prices (1990=100)

National currencies.

| 1978 | 1982 | 1986 | 1988 | 1990 | 1992 | 1993 | 1994 | Q295 | |

| End-user price gas | 101 | 158 | 129 | 97 | 100 | 101 | 99 | 97 | 96 |

| End-user prices oil products | 97 | 147 | 100 | 88 | 100 | 98 | 100 | 101 | 101 |

| Import price natural gas | .. | .. | 98 | 62 | 100 | 94 | 92 | 88 | .. |

| Import price crude oil | 215 | 84 | 73 | 100 | 76 | 66 | 61 |

Source: IEA. The indexes for gas import prices are

calculated on the basis of nominal import prices from the IEA and deflated

with the same factor as used by the IEA for the deflation of oil prices.

Table 1 shows indexes for end-user prices on gas in OECD-Europe for

the period 1978-1995 with 1990 as the base year. The indexes show that

these prices follow quite close the development of end-user oil product

prices, except of the first years after the crude oil price drop in 1985/86.

However, import prices of natural gas (producing countries export prices)

have fallen much less than import prices on crude oil (the crude oil price).

This is mainly because, since 1986, the fall in crude oil prices largely

is "compensated" for by increased taxation of fuel oils.

Effects on Prices of Market Liberalization

In general, liberalization of the European gas market will increase the number of actors operating and transactions made in the market, as well as the speed of reactions in one segment to changes in another. For example, when producers and customers make direct contracts and pipelines are not acting as balancing intermediators anymore, market conditions, such as in customers willingness to pay, may more quickly affect producers' prices. The number of actors increases and the volumes of each contract (at least for producers) decrease. Brokers and marketers may establish themselves to clear (parts of) the market, in addition to the direct contact between parties.

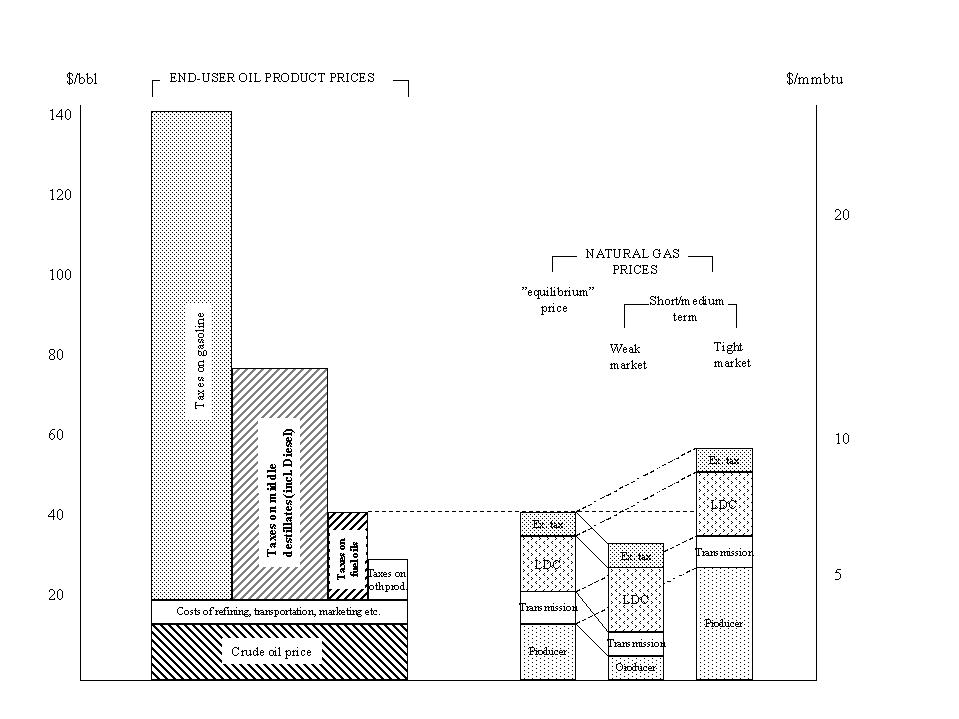

Prices become more volatile as they react to market changes not only

in the long term, but through gas-to-gas competition also in the

short and medium term (up to as much as 5-10 years). In a surplus situation,

a "gas bubble" would suppress prices in short term contracts. When demand

exceeds supply, spot and other short term prices will be pushed up. When

a short term market for natural gas is developed, it may work as a barometer

for the (underlying) trend in long term prices. Depending on how the balance

between supply and demand develops, prices may actually end up both below

and above the prices within the existing system, as illustrated in figure

2.

Figure 2; Increased Price Volatility in a Liberalized Market

(Simplified illustration)

A tight gas market will produce more long-term, and a weak market more

short term contracts (including possible spot sales). With a higher number

of actors and increased volatility, "long term" in a new market structure

will be shorter than in the existing system. More short term transactions

indicate greater variations in short and medium term prices depending on

market tightness. How strong and quick responses will be, depend, besides

on market conditions, on degree and shape of liberalization and firms'

remaining market power. The increased number of short term contracts will

partly replace existing long term contracts, but partly also satisfy customers

not able to buy gas under today's system (with greater rigidity). Thus,

demand may grow under liberalization.

The question has been raised whether gas could be priced independently of its alternatives. Over time, that is not possible for any commodity. In the U.S., gas prices have been lower than its alternatives for many years. However, these low prices were probably a result of the gas "bubble" existing after the mid 1980s, representing an over-supply in the market. As consumption gradually reabsorbed available production capacity, prices has been rising. Also in the U.S., the market value principle for end-user prices of gas seems to be valid, even though differences may occur over the short and medium term (which in the gas market may be a number of years).

If pipelines becomes regulated or competition between them intensifies (which may be possible in areas with high demand for gas transportation), gas from different sources meets in "gas-to-gas competition" at the customers level (at the city-gate where LDCs, power plants and large industrial users buy their gas), rather than on importing countries' borders (where merchant pipelines buy their gas). If producers maintain today's market position (as oligopolists), and transaction costs are not too high, they should meet a weaker and more diversified group of buyers at the customers level than at today's monopsonistic import level. Customers should also be better off by meeting a somewhat more diversified group of exporters than the monopolist they face in the form of a merchant pipeline.

In this case, customers' purchasing price should drop at the same time as producers' price increases. This implies that customers and producers share the rent made available from increased competition between pipelines. For both producers and customers it will be important to maintain a purchasing position as concentrated as possible. If, on the other hand, exporting countries' selling monopolies are abolished or weakened, and today's purchasing pipeline consortium maintained, each company within a single producing/exporting country should sell gas directly to the purchasing pipeline consortium. This would improve the relative position of the merchant pipelines and should lower producer prices to the benefit of the pipeline.

Theoretically, if no regulation of single firms takes place, but unbundling (throughout the gas chain) and price transparency are introduced and horizontal collaboration is made illegal both between producing companies and pipelines, this should have the potential of increasing the relative market power to pipelines. This is due to the assumption that pipelines have greater elements of natural monopoly than do producing companies. Thus, the most significant threat to pipelines' profit may be an actual regulation of the terms for operation, rather than increased competition, unless competition takes place only in the transmission segment. If regulation of transporters behavior ultimately is introduced, LDCs and pipelines may become more concerned about how regulation is made and may try to "trap" the regulator to serve their interests, rather than be concerned about their position towards their respective sellers and buyers.

If pipelines transporting and merchant functions are unbundled and their margins are competed or regulated down, they may be unable to fulfill their obligations towards producers in existing take-or-pay clauses. These experiences were made in the U.S. in the mid 1980s after the introduction of Open Access under Order 436 simultaneously with the oversupply of gas in the market, as well. Similarly, contracts signed between pipelines and LDCs can neither be maintained. Pipelines' stabilizing brokerage function must be overtaken by producers and customers through a greater and more diverse contract portfolio. Many of the existing contracts must be replaced with new contracts between producers and customers. Alternatively, producers may be forced to relief merchant pipelines from their TOP obligations.

Corrected for transaction costs, producers would benefit from selling

gas directly to customers when end-user markets are tight. Similarly, customers

could benefit from buying gas directly from producers in a weak market.

Thus, the process moving from one set/type of contracts to another as the

market becomes more liberal, may take the form of various parties (including

exporters/producers) claiming the termination or renegotiation of existing

contracts (perhaps on a force majeure basis).

Gas Prices and Natural Gas Excise Taxes in Consuming Countries

European taxes on gas usage have been is much more moderate than oil

product taxation. As percentage share of end user prices, gas taxes have

increased from some 15 % in 1984 to some 20 % in 1994 (table 2). Taxation

of gas to power plants and the industry is lower, in many countries zero.

Even though gas taxes are low compared to oil product taxation, taxes on

polluting coal is even less, in fact coal is in many countries subsidized.

This tax-structure reinforces the impression that energy taxation in consuming

countries is not primarily set with reference to the environment, but first

of all from fiscal needs, often as replacement for lower income taxes.

Table 2; Taxes as Share of End User Prices on Gas

and Coal in Selected Countries

| Households | Electricity | Industry | Coal to industry | |||||

| 1984 | 1994 | 1984 | 1994 | 1984 | 1994 | 1984 | 1994 | |

| Austria | 16.7 | 16.7 | 0.0 | n.a. | 0.0 | 0.0 | 0.0. | 0.0 |

| Belgium | 14.5 | 21.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | n.a. |

| Denmark | 18.0 | 20.0 | n.a. | n.a | n.a. | n.a. | 0.0 | 14.7 |

| Finland | 1.7 | 21.2 | n.a. | n.a. | 1.7 | 4.1 | 9.6 | 13.8 |

| France | 15.7 | 13.6 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Germany | 12.3 | 19.0 | n.a. | 16.6 | 0.0 | 13.5 | 0.0 | 0.0 |

| Great Britain | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | o.o |

| Italy | 13.4 | 42.1 | 0.0 | 0.0 | 0.0 | 11.6 | 0.0 | n.a. |

| Netherlands | 16.0 | 19.1 | 0.1 | n.a. | 0.0 | n.a. | 0.0 | n.a. |

| Spain | 1.5 | n.a. | 1.5 | n.a. | 1.5 | n.a. | n.a. | n.a. |

| -USA* | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| -Canada | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| -Japan | 0.6 | 2.9 | 0.0 | n.a. | 0.9 | 2.9 | n.a. | 2.9 |

| -New Zealand | 8.1 | 14.9 | n.a. | n.a. | 11.3 | 16.8 | 1.6 | n.a. |

Source: IEA (n.a.: not available/relevant). * Taxes on gas use varies between 3-6 % of end-user prices (IEA).

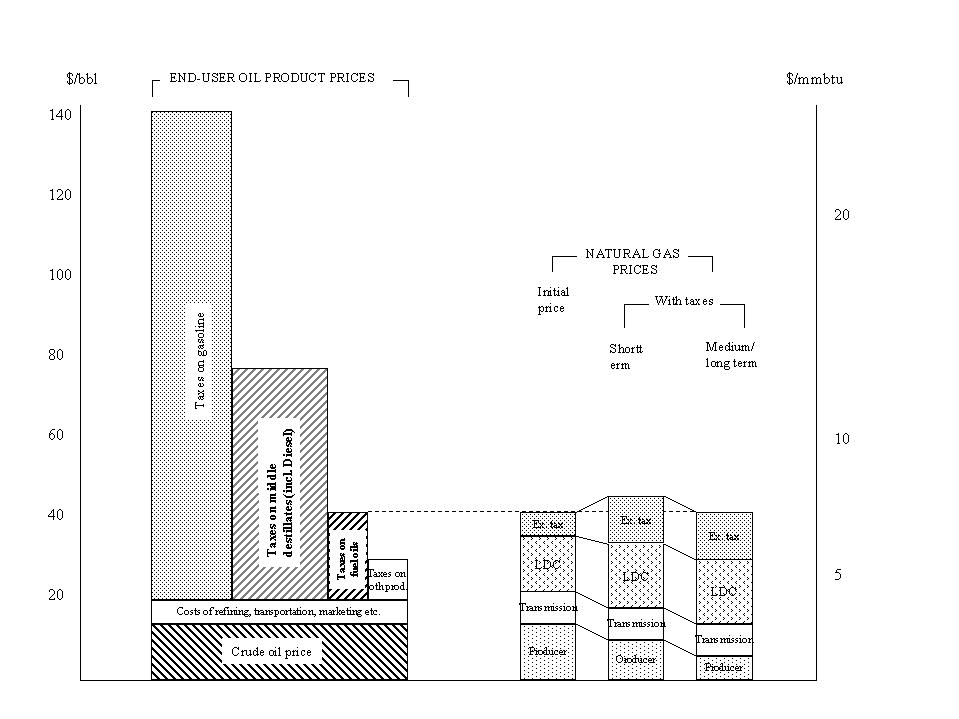

If gas taxes are raised, a first effect could be that the increase is partly producer and partly consumer paid, as shown in the middle gas bar in figure 3. However, a tax rise must, eventually, push prices further up in the gas chain down, as consumer prices over time can not be higher than the price of its alternatives. In the short term it is possible that the tax is partly paid by end-users, depending on how (in)elastic demand for gas is. If gas prices initially is lower than the price of its alternatives (in order to increase gas' share of overall energy demand), consumers may pay the tax more permanently on the cost of a lower growth of gas demand. If the transporters (pipelines and LDCs) take a higher price for gas than what the initial relationship between gas prices and its alternatives presupposes, the transporters may also pay the tax in the short term at the cost of a lower profit margin (loss of some economic rent). If, however, demand growth should be maintained, or the market is matured in a way that end-user prices on gas equal prices on its alternatives, the tax must be paid by producer or the transporters through negotiations.

How these negotiations end up depend on parties' cost, negotiation strength/market

power, jura etc. As already mentioned, historically, transporters margins

seem rather independent of end-user prices in the negotiations. As long

as transporters can argue that the level of their (rather high) existing

margins are necessary to cover costs, an increase in taxes will not be

borne by them. Thus, with fixed margins to LDCs and pipelines, a gas tax

must, eventually, be borne by producers. This is shown in the third gas

bar to the right in figure 3.

Figure 3; Natural Gas Excise Taxes and Natural Gas Prices

(Simplified illustration)

The less dependent margins to pipelines and LDCs are on end-user prices,

the more of the tax, if not all, must, eventually, be borne by producers/exporters.

The heavy taxation of oil products over the last decade is an illustration

on how popular taxation of energy has become in consuming countries in

general, and in the EU, in particular. As consumption of gas largely takes

place within the Union and increasingly more production takes place outside,

gas taxes may become particularly attractive for consuming countries as

a source of revenue and transfer of rent from producers to consuming countries'

treasuries.

Worst case scenario for gas exporters occurs when they have "fully" developed fields and pipelines. At this stage, most producers' costs are sunk, and producers have no alternative but to continue supplying gas through existing facilities and grids, even though prices are well below what was expected. In the extreme, if no new capacity is to be made available, taxes could be raised to the point where producers' prices just cover a little more than variable costs. With all cost sunk, producers would benefit from continuing producing even if prices do not cover fixed costs.

In fact, by using the tax instrument, consuming countries may determine producers' profit even more directly in the gas market than in the oil market, without hurting the consumer. The limits to taxation, at a given status of the market, will be determined by the cost of getting new gas to the market (long term marginal cost of gas production). The higher the ambition of increasing gas consumption, the lower the taxes must be. But producer prices need not be higher than what is "necessary" in order to producers invest in new capacity. As long as some rent, with "reasonable certainty", is left to a producer making calculations for new field developments, he will invest. However, if gas taxes will be used as a strategic economic instrument among consuming countries to derive rent, the only fields making economic rent may, eventually, be those of low cost. Furthermore, the more cost effectively producers can operate, the higher taxes can be, as well. Thus, an owner of an exhaustible resource must, over time, not necessarily earn economic rent, even if consumer prices are rising.

An increase in gas excise taxes may become particularly attractive for consuming countries' governments when rent is made available in the gas chain, whatever the cause. This is what has happened in the oil market over the last decade. When crude oil prices dropped in 1986 and 1991, consumers could have derived the benefit from the loss of rent among producers. However, consuming countries raised oil product taxation, which stabilized end-user prices on oil and suppressed a potential later price rise on crude oil. As downward trend in crude oil prices can be used to increase oil product taxation, while an upward trend can be used to increase gas taxes, energy taxation as such may become a major political challenge for both oil and gas producers in their relations to importing countries.

With no tax changes, regulations of LDCs could benefit transmission lines and/or exporters (depending on the remaining market structure). Similarly, regulation of pipelines could benefit exporters and/or customers. In these cases, local and national authorities may be better off by leaving the rent in the local or national company, rather than sending it (in most cases) out of the region or abroad. Then, it may seem better to leave the market "unregulated". If, however, these authorities can collect the rent made available through taxation, the desire to regulate down margins in transmission and/or distribution could be reinforced.

If gas taxes are increased simultaneously with the use of "invisible"

and "visible" hands that reduce profit margins and improve cost effectiveness

in transmission and distribution companies, the EU may more easily get

support from national governments in proceeding with the liberalization

process. An active use of gas taxes as a strategic instrument to derive

rent, may increase the probability of a politically led liberalization

process both on local, national and EU levels.

LITERATURE

Austvik, Ole Gunnar, 1995; Liberalization of the European Gas Market; The Workings of Visible and Invisible Hands, Final report to the Norwegian Research Council (PETRO-program no. 106208/510). 208 pages.

---, 1996; Avgifter og petroleumspriser: Tar konsumentlandene olje- og gassinntektene?, Sosialøkonomen no 4. april.

ECON, 1995; Energy Taxes in the OECD. ECON-rapport no. 332/95.

European Union, 1988; The Internal Energy Market, Commission Working Document, May

---, 1990; Council Directive of 29 June 1990 concerning a community procedure to improve the transparency of gas and electricity prices charged to industrial end-users, CEL-Title 90/377/EEC

---, 1991; Council Directive of 31 May 1991 on the TRANSIT of natural gas through grids, CEL Title 91/296/EEC

---, 1992; Proposal for a Council directive concerning common rules for the internal market in natural gas (Third Party Access, TPA, directive), Com 91/548 Final SYN 385.

International Energy Agency (IEA), 1994; Natural Gas Transportation; Organization and Regulation, Paris

Noreng, Øystein, 1994; Liberalisering av det europeiske gassmarkedet, Report to Ministry of Industry and Energy (with contributions from Ole Gunnar Austvik), u.o.