|

Energy Challenges for Europe Article in

Structural Change

in Europe; Cities and Regions - Facing up to Change

|

Energy prices have been rising rapidly over the past years. The most important reason is the growing imbalance between global oil demand and supply. Strong economic growth in China and other Asian countries, and the lack of adequate additional oil supplies e.g. from the Middle East, are major reasons for real oil prices climbing almost as high as in the early 1980s. High oil prices are transferred to natural gas prices and, consequently, to electricity prices.

European energy prices depend heavily on global energy prices. At the same time, increasingly more energy is imported to the EU. The exposure to external price and supply shocks poses questions about the sustainability of future European energy supply, energy mix and efficiency, as well as geopolitical balances. Rapidly rising fuel prices and possible supply disruptions can have serious consequences for economic growth, political stability and EU’s competitive position.

The import dependency can make EU economies potentially sensitive and vulnerable to external events. The expressed worries over the development of the structure of the Russian oil and gas sector, and on gas (and oil) transit problems through Ukraine and Byelorussia, illustrate that such issues are now high up on the EU political agenda. Political unrest in the Middle East is another element that reinforces the attention on energy issues.

Energy usage is also closely linked to emissions of greenhouse gases

and their implications for climate change, air quality in densely populated

areas and other environmental risks. Reduction of energy usage, improvement

in energy efficiency and development of clean technologies could help the

environment. For the EU, it is a challenge to enhance environmental standards

and secure supply, and at the same time keep the European economy competitive

on the global stage. The challenges press for new and more comprehensive

EU policies, as well as actions on national, regional and city levels.

| Remark: You are welcome to download, print and use this full-text document and the links attached to it. Proper reference to author, title and publisher must be made when you use the material in your own writings, in private, in your organization, in public or otherwise. However, the document cannot, partially or fully, be used for commercial purposes, without a written permit. |

Continued reliance on fossil fuels

With almost 500 million people after the last expansion to 27 countries

(2007), EU energy consumption represents some 18% of world energy consumption,

only surpassed by the US (23%). The dominant fuel is oil (40% of total),

but natural gas is by far the fastest growing fuel source. Natural gas

accounted for 24% of consumption in 2005. Natural gas usage has increased

both due to higher overall energy demand and a decline in coal consumption

from 20% in 1991 to 17% in 2005. Nuclear production has been quite stable

and represented 13% of total energy consumption in 2005, while hydro electricity

accounted for 4%. This leaves only 2% for other renewable energy sources,

comprising wind, geothermal, solar, biofuels and others.

As 83% of EU energy consumption consists of fossil fuels (oil, gas and coal), and the EU possesses only minor parts of world reserves of these fuels, she depends heavily on energy import. Although usage of non-fossil fuels and renewable energy sources are expected to grow in the coming years, the bulk of increases in energy demand must continue to come from the exhaustibles, unless not only incremental technological improvements, but a substantial technological breakthrough, takes place.

While 50% of EU energy consumption is imported now, expectations are that about 70% of overall energy requirements will be imported in 20 to 30 years (EU2006b). It is in particular increases in natural gas consumption that will raise EU energy imports, while oil and coal consumption is expected to remain more stable. In most analyses the high relative dependency on fossil fuels in overall energy demand is expected sustain over the next decades.

Energy efficiency improved

Energy demand is determined by factors such as economic activity, weather

conditions and behavioral pattern among consumers. The measurement of ‘energy

intensity’ has been used to determine how these activities translate into

energy demand. This broad indicator is defined as energy consumption per

unit of GDP. It reflects a series of factors, such as technical efficiency

of energy usage, productivity increases and structural changes such a relocation

of production or sector re-composition.

In the EU, energy intensity has fallen sharply for the new member states

(EU-10), and to a lesser degree for the old ones (EU-15). The EU-10 countries

are however historically at much higher energy intensity and are consequently

approaching the levels of the EU-15. Due to efficiency improvements, reflected

in lower energy intensities, final energy demand is growing marginally

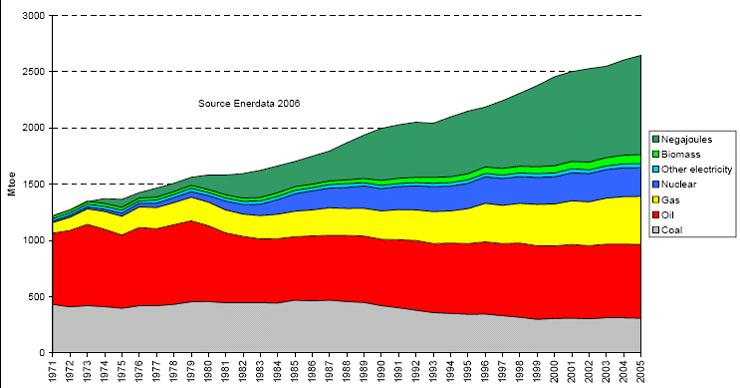

faster than primary energy demand. As is shown in Figure 1, energy demand

would have been much higher today without efficiency improvements in energy

usage over the past three decades. Rather than a 100% increase in energy

usage over the period, the actual increase has been ‘only’ some 50 %.

Figure 1.Development of primary energy demand and of “negajoules”

in EU-25 1971-2005

“Negajoules”: energy savings calculated on the basis pf 1971 energy

intensity

(Source: EU 2006c: 5):

Improved energy efficiency helps reducing costs for the industry; reduce emissions and other environmental damages as well as it reduces import dependency. Hence, energy efficiency is a very important element in approaching all EU energy political goals. Improvements have been realized mainly through better final energy usage in power stations, refineries, combustion engines and boilers. Also reduced losses in transmission and insulation of buildings have helped. In the transportation sector reduced consumption of gasoline and diesel in vehicles as well as social, economic and organizational changes have been significant.

As shown in Figure 1, energy efficiency improvement has actually been the most important growing “source” of energy supply over the past 3 decades. Such avoided energy consumption through savings should be even more important in the future. Much of the rationalization in transportation, and in energy supply and consumption, remains largely untapped.

Opening of gas and electricity markets

An important element in natural gas demand growth is the need for more

electric power. Electricity demand is expected to continue to account for

less than a quarter of final energy consumption. Power production based

on oil and coal declines however very rapidly, while nuclear power production

has been expected to marginally decline. 57 % of EU electricity production

was based on fossil fuels in 2003. This share has been expected to increase,

in spite of a steady growth in renewables sources, as well as a possible

re-emphasis on nuclear energy. The declines in oil and gas generation capacity,

coupled with an strong expected growth in electricity demand, should be

met with a dramatic increase in gas turbine combined cycle plants and small

gas turbines. The expected 10 times (!) capacity increase in gas fired

power plants should rise its share of total installed capacity to 45 %

by 2020 (EU 1999).

One important policy aiming at making gas and electricity markets work better, has been a long political process to open national markets, ease border crossings and enhance competition. To speed up market openings, new electricity and gas Directives were adopted in 2003 (EU 2003a,b), to be completed in 2007. In many new member states, however, national state-controlled electricity and gas champions are still active. In addition, large gas companies have moved downstream and now directly market their products to end users, especially natural gas. In gas infrastructure they are increasingly present. Different regulatory practices in member states still hampers the free flow of, especially, natural gas. Accordingly, gas and electricity markets have become more open and ‘liberal’ than before, but are in many cases still far from being de facto fully liberalized. The consequence is that especially retail electricity prices vary considerably across member states.

Competition is by the EU seen as a prerequisite for competitiveness, sustainability and energy security. However, because of the imperfect structures of the electricity and natural gas markets, for example where competition cannot be introduced due to natural monopoly economics, liberalization cannot imply a laissez-faire attitude to price outcomes and customer service. In order to improve the shortcomings of the present status of the markets, the EU aims at a clearer separation of energy production and distribution, as well as stronger independent regulatory control, including considering the possibility of setting up a ‘federal’ regulatory body or coordinator at the EU level.

Increased competition also implies a change in the way investment decisions are made. In the old system new capacity was constructed on a “predict and provide” basis, often leading to over-capacity. In a liberalized market investors will make investment decisions based on price signals and expectations about long-term price trends. The EU emphasizes the benefits of lower operational costs and increased flexibility due to liberalization and tougher price competition. However, less focus has been on the fact that more short-term contracts, increased volatility and periodically low prices will tend to delay production decisions. Consequently, there is a question whether enough foreign primary fossil resources will be provided on a stable basis to meet the increasing demand in a fully liberalized natural gas market.

At the same time, the EU considers that it is beneficial that the EU has large companies in the energy sector to maintain a strong buying power especially in the natural gas market, even if an excessive market power in certain regions can limit the benefit and possibility for competition (EU 2005a:18). The principles of competition are challenged by an element of interest conflict between outside producers and the EU. The EU has a fear that foreign gas producers can get a disproportioned market power. These dilemmas show that there is a need for the EU to develop dialogues with producing countries to balance out the elements of conflicting interests in how producing countries behave and how the EU organizes her markets.

Harmonization of energy taxes

One important element determining market outcomes is taxation. Energy

taxes are in many countries a substantial part of end-user prices. In the

EU, these taxes have varied substantially. To counter the divergences,

a tax Directive (EU 2003d) was adopted right after the adoption of the

gas and electricity directives. This directive widened the scope of the

EU minimum rate system, which was previously limited to oil products, to

include all energy products including coal, natural gas and electricity.

The directive was designed to reduce distortions in competition between

member states and between mineral oil and other energy products, increase

incentives to use energy more efficiently and reduce CO2 emissions and

energy imports.

An increase in these taxes may become particularly attractive for consuming countries' governments when rent is made available in the gas chain. This can happen when prices are falling. In the European natural gas market, the combined group of EU economies is close to the role of a single buyer for exporting countries like Norway and Russia. Harmonized excise taxes on natural gas consumption may pressure exporting countries’ prices down in same way a tariff can do for large importing countries and serve a similar function as an optimal tariff, as we know from international trade theory.

Because such processes may lead to a pressure on exporting countries’ prices and the distribution of rent among countries, gas taxation may become a political issue for oil and gas producers in their relations to the EU. Worst-case scenario for exporters occurs when fields and pipelines are "fully" developed. At this stage, most producers' costs are sunk, and producers have no alternative but to continue supplying gas through existing facilities and grids even though prices are well below what was expected. In the very extreme, if no new capacity can be developed, taxes could be raised to the point where producers' prices just cover a little more than variable costs. Together with effects from market liberalization and resource concentration, the development of natural gas taxes contributes to the uncertainty whether or not there will be sufficient increases in supply of natural gas to meet demand.

Growing dependence on energy imports

The significant growth in demand for natural gas make it necessary

to increase imports from a number of distant fields in Russia, Norway,

Africa, Central Asia and the Middle East. EU2006b estimates that gas import

will increase 80% over the next 25 years. This will require the financing

of a number of new and expensive gas pipeline projects, in addition to

investments in large field developments in producing countries. In addition

to market reorganization and fiscal policy in the EU, such investments

depend on organizational matters and policies in the producing countries.

Seen from an EU point of interest, producing countries should welcome foreign

investments in their energy industries and open their transportation networks

for all parties.

For the two biggest natural gas exporters, Russia and Norway, the situation is quite different. Norway must adhere to EU laws and regulations through the EEA agreement, following general competition principles and the Gas Directives. Consequently, each company in Norway now sells their gas. The transmission network on the Norwegian Continental Shelf provides en open access for everyone. Norwegian production of natural gas is increasing rapidly and will reach her maximum sustainable capacity in a few years.

Russia is however is the decisive energy supplier to the EU, with her enormous oil and gas resources. As shown in Figure 2, a comprehensive network of oil and gas pipelines has been developed between Russia and the EU, many of them from Soviet times. But Russia has no EEA agreement or (so far) other arrangements that tells her to open her energy markets. Most of her natural gas production and all transmission is organized under one body (Gazprom). State-owned Transneft has a transportation and export monopoly on Russian oil.

Figure 2: Russian oil and gas to Europe

(Source: EIA 2007):

There have been no plans to let Russian gas companies compete in export markets, although the independent companies want to do it. There were plans to unbundle and liberalize some Gazprom activities a few years ago. However, the concentration of power on Gazprom hands, as well as the government hand on Gazprom, has rather tightened than become weaker.

Even though Russia is not affected directly by EU gas regulations in the way that she organizes her industry, she will meet the same uncertainty in terms of increased volatility in prices. There will be more short-term contracts and she will run the political risk that gas taxes may suppress EU import prices (Norway’s and Russia’s export prices) as Norway does. This could hamper investments in the large new production fields and transportation infrastructure in Russia, as well. The EU-Russia energy dialogue has, inter alia, been established to aim at solving this type of problems. Such dilemmas will arise also when the EU starts to import gas from new sources for example in Central Asia.

Most signs are that the Russian governments wants to choose her own arrangements for the petroleum sector, and even use it for political leverage. Because Russia can maintain such a concentrated industrial structure, and Norway not, Russia will remain in a stronger position than Norway in the future in terms of market power. With a Russian WTO membership, domestic Russian energy prices must gradually raise to international levels. This will reduce Russian domestic consumption, system losses and improve efficiency. More gas will be available for exports, which will help the energy situation for the EU. It will also reinforce the trend that European dependency on Russian gas will increase.

Environmental challenges

Under the 1997 Kyoto Protocol, the EU is obliged to reduce its greenhouse

gas emissions to 8 % under the 1990 level by 2008-2012. In 2003, the EU

Parliament and Council issued a Directive (EU 2003c) establishing an emission-trading

scheme, which became operational in January 2005. According to this directive

all emitting undertakings must hold an emission permit from its government.

Emission needs higher or lower than the allocated emission rights, can

be bought and sold in the market or saved for future use.

To improve the environment, the Commission proposes (EU 2007) that 20 % of its energy mix should come from renewables by 2020 (from the present 6 %), where as biofuels should have a minimum target of 10 %. Energy research should increase by at lest 50 % over the next 7 years, with the aim of being in the forefront of the rapidly growing low carbon technology sector. Development of cleaner coal based electricity plants should be emphasized, as reserves for coal are substantial also within the EU. Both coal and gas based power plants should develop a program for CO2 capture. If these proposals are implemented, the EU will be world leader in efforts to reduce environmental damages from human activity.

Towards a more comprehensive EU energy policy

Intra-European energy trade is already substantial and is expected

to grow over the next decades, especially for natural gas. Energy markets

tend however to remain tight, with potential high and volatile prices following.

Global demand for energy is expected to increase by some 60 % by 2030 (EU

2006b), with the following CO2 emissions. The potential for a more severe

energy crisis is apparent, as well as breakdowns in infrastructural bottlenecks.

At the same time, the EU depends increasingly more on energy imports.

For the EU, it is a challenge to develop market reform and liberalization in a way that prices are stabilized over time, and to give supply a chance to grow in line with demand. If successful, the chance of a prolonged energy crisis is less obvious. At the same time, EU relations with especially foreign gas producers will become more important in the future, especially with Russia but also with Norway, Central Asia, North Africa and the Middle East.

The high prices trigger greater energy efficiency and innovation, as well as new policies. Policies that aim at either improving competitiveness, supply security or the environment often contradict each other. For example, switching fuels from domestic coal to imported gas reduces CO2 emissions, but contributes to increased dependence on natural gas imports. Accordingly, the Commission has increasingly focused attention on coordinating policies for the three areas (EU 2005b, 2006b).

In the “An energy policy for Europe” report (EU 2007) the Commission sets up a goal of a 13 % reduction in energy consumption by 2020 compared to 2006, due to a 20 % saving through improved energy efficiency. The proposal comprises acceleration of and emphasis on all the processes already contributing to energy savings, besides a new international agreement on energy efficiency. The plan is that the EU should speak with one “coherent and credible” voice in external affairs, acknowledging that the EU cannot achieve its energy and environmental objectives only on its own.

The common external energy policy should also deal with external energy supply crises, and strengthen the Energy Charter Treaty and post-Kyoto climate regime, such as in the relation to Russia and an extension of the emission-trading regime to global partners. In this proposed new (common) European Energy Policy, sector enquiry, strategic review and action plan should seek together to move from principles to concrete legislative proposals in 2007-08.

A most important element in intra-EU policies remains to be improved energy efficiency and flexibility in terms of ability to choose between transportation alternatives, energy carriers and suppliers. These sub-goals help all three main EU energy and environmental objectives; competitiveness and the Lisbon agenda; environmental protection and the Kyoto protocol; reduction of energy imports. Policies now aiming at identifying the bottlenecks preventing cost-effective improvements from being captured, such as lack of incentives, information, financing, relevant tax structures, law making and others are important.

Improved energy efficiency and diversification between energy sources will be at the core of EU energy policy over the next years. It should also be essential for national, regional and city planners, as well as business enterprises and homeowners.

References:

EIA, Energy Information Agency, 2006: Country Analysis Brief; “European Union” EU, European Union, 1999: European Union Energy Outlook to 2020

EU 2003a: Common rules for the internal market in natural gas and repealing Directive 98/30/EC, Council Directive 2003/55/EC, 26.6.2003

EU 2003b: Common rules for the internal market in electricity and repealing Directive 96/92/EC, Council Directive 2003/54/EC, 26.6.2003.

EU 2003c: Establishing a scheme for greenhouse gas emission allowance trading within the Community and amending Council Directive 96/61/EC, Council Directive 2003/87/EC, 13.10.2003.

EU 2003d: Restructuring the Community framework for the taxation of energy products and electricity, Council Directive 2003/96/EC 27.10.2003

EU 2005a: The Annual energy and transport review for 2004.

EU 2005b: Doing more with less: Green paper on energy efficiency

EU 2006b: A European strategy for sustainable, competitive and secure energy, Green paper COM (2006) 105 final 8.3.2006

EU 2006c: Action plan for energy efficiency: Realizing the potential, COM (2006)545 final 19.10.2006

EU 2007: An energy policy for Europe. Commission steps up the energy challenges of the 21th century.